Online MBA in Finance & Accounting Management from Amity University (AU)

An online MBA in Finance & Accounting Management from Amity Online University (AU) is an incredibly comprehensive and rigorous program that provides students with a complete foundation in finance and accounting. Students of this program will gain a strong understanding of financial theory and practice and the ability to analyze and interpret financial data.

Through the course, students comprehensively understand financial markets, financial institutions, investments, and taxation. Furthermore, the program helps students to provide with the tools to understand the problem of the global financial system and the ability to make informed decisions that benefit their organization and their career.

Besides, you can gain competitive benefits and significantly increase many chances in addition to a well-paid job with a recognized company. Even if you have post-gradation degrees, you can consider an online MBA in Finance Management to boost your resume and knowledge.

The perks of pursuing an online MBA in Finance Management can include a wide array of benefits and opportunities. The perks include better career prospects, higher salary benefits, networking opportunities, improved business skills, entrepreneurial opportunities, etc.

People with a knack for business analytics, accountancy, financial analysis, and overall market analysis can opt for this degree.

Online MBA in Finance Management is for students who

- Have a strong inclination toward finance and its subparts.

- Passion for finance.

- Have strong analytical and quantitative skill sets.

- Desire to work in the finance industry- as this isn’t a career limited to a single field and can be implemented in numerous others.

- Interest in investing and investing management.

- Desire to work with corporate finance.

About Amity University (AU)

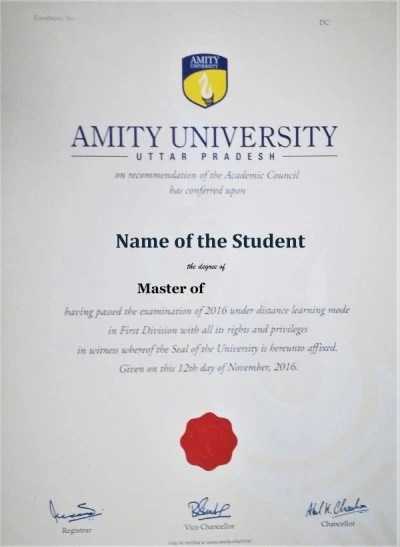

Amity University (AU) offers an online MBA program in Finance & Accounting Management. NAAC has accredited Grade A+ to the online university, and UGC has approved it. Further, A broad range of learning opportunities and practical experiences is provided to the students by the university. The online university offers workshops, seminars, and access to online resources. Moreover, the faculty members draw on their professional experience to provide students with real-world business insight. Lastly, Amity University’s online MBA boasts a wide range of specializations so that you can find the perfect course for you.

Admission Process

The admission eligibility criteria for an online MBA in Finance & Accounting Management of Amity University (AU) includes:

- Candidate should have a degree in any discipline from a recognized board or University.

- Minimum of 50% marks is required for general category

- Minimum of 45% marks is required for reserved category

The university is very flexible and widens the scope of admission for the pool of applicants. Furthermore, an online MBA in Finance Management and Accounting course is online. Hence, it is accessible since you can pursue it from anywhere. Some intriguing topics demonstrated during this program are Financial Planning, Financial Analysis, Capital Budgeting, Risk Management, Financial Control, and many more.

Career Options after an Online MBA in Finance & Accounting Management

Pursuing an online MBA in Finance Management and Accounting gives you great opportunities to work in the finance industry. Financial Management and Accounting is an essential tool within any company that helps with the effective and efficient use of financial resources throughout the firm’s financial year. It helps in maximum resource utilization and helps achieve the basic objectives of the company.

Real GDP growth is estimated to reach 6.5% for the fiscal year 2024 (Source: The Economic Times). Therefore, it will open numerous job opportunities in various sectors including Finance & Accounting sector. Hence, below are some career options listed that will help you to choose the best option for you:

Venture Capitalist

Venture capitalists invest in early-stage or high-growth companies with the potential for significant returns. Moreover, you would evaluate investment opportunities, conduct due diligence, negotiate deals, and provide strategic guidance and support to portfolio companies.

Risk Manager

Risk managers are critical in identifying, assessing, and mitigating organizational risks. Moreover, you would develop risk management strategies, analyze financial data, implement risk control measures, and ensure compliance with regulatory requirements.

Financial Analyst

Financial analysts analyze financial data and market trends to provide insights and recommendations to businesses and investors. Moreover, you would assess investment opportunities, perform valuation analysis, prepare financial models, and contribute to investment decision-making processes.

Corporate Treasurer

Corporate treasurers manage an organization’s financial resources and liquidity. Moreover, you would oversee cash flow management, manage banking relationships, assess and mitigate financial risks, and develop strategies to optimize the company’s financial position.

Financial Consultant

Financial consultants provide individuals and businesses with personalized financial advice and guidance. Moreover, you would assess clients’ financial situations, develop financial plans, provide investment recommendations, and help clients achieve their financial goals.

Corporate Finance

These people help organizations make financial decisions, manage budgets, analyze investment projects, and optimize capital structure.

Financial Planning

Help individuals and families create and implement comprehensive financial plans, including budgeting, tax planning, retirement planning, and investment strategies.

Financial Consulting

After MBA in Finance & accounting, one can choose to a field of Financial Consulting. They, provide advisory services to clients on financial management, risk assessment, financial restructuring, or investment strategies.

Insurance

Explore opportunities in insurance companies, such as underwriting, claims management, actuarial analysis, or risk assessment.

Some other important career options include Chief Financial Manager, Corporate Controller, Management Consultant, Credit Manager, and many more.

As the population increases, the demand for online MBAs in the financial field has also increased. An online MBA in itself is one of the most in-demand degrees around the world. Further, with all the skills you have for the finance field at your startup, adding an online MBA degree will increase your market value. It is an added advantage; now, you can take it from your home on your screen.

Other options include working as a financial consultant, investment banker, or venture capitalist. Many online MBA graduates also pursue consulting, management, or marketing careers. Further, the average salary is typically between 7 and 20 lakhs annually, depending on the job role (Source: Times of India). Hence, with an online MBA in Finance and Accounting Management, the possibilities for career growth are endless.